7 Lesser-Known Costs of Home Ownership

Owning a home is one of the best investments you can make. However, there are many lesser-known costs of home ownership that homebuyers often overlook. From maintenance and mortgage insurance to utilities and property taxes, there is a lot to consider. To help ensure you’re fully prepared for buying a home, Maleno compiled this list of seven hidden costs of owning a home you should know about.

1. Closing Costs

When you close on a home, you’ll have to pay closing costs. Closing costs include a myriad of fees, including, but not limited to:

|

|

A safe estimation of closing costs is between two and five percent of the home’s purchase price. The price may be at the upper end of that estimation if you’re in a location with particularly high transfer and deed recordation taxes. But you can also take several steps to minimize your closing costs, such as:

- Comparing loan origination fees

- Shopping around for attorneys

- Asking the seller for a credit

- Look for closing cost assistance programs

2. Home Maintenance

Home maintenance bills can add up fast, especially if you need a new roof, foundation repairs, or a furnace replaced. But even without those big ticket items, daily maintenance still racks up. Based on data from millions of home projects, Thumbtack and Zillow determined that the average annual home repair costs equate to $6,413.

3. Homeowners Association Fees

There are a lot of benefits to living in a neighborhood with a homeowners association (HOA). For instance, members of an HOA may enjoy:

- Access to a community center, pool, or tennis court

- Aesthetic standards for all properties in the community

- Disaster relief and maintenance

- Landscaping and snow plowing services

- Road and sidewalk paving and upkeep

- Safe and well-lit areas

- Trash removal

However, these benefits do come with a cost. On average, Pennsylvania HOA fees add up to $3,500 per year.

4. Homeowners Insurance

There are a multitude of factors that determine your home insurance premium, such as the location of your home, the amount and type of coverage you hold, and the condition of your home. The average home insurance cost in Pennsylvania is $1,760 per year or $146 per month.

We’ve been asked the question before, “Do you need home insurance?” While legally, it’s not required, it is required by lenders as a condition of your mortgage. We’d also argue that home insurance is vital even if you’re not financing your home. Ultimately, the annual cost can be a small price to pay should anything catastrophic happen to or on your property.

5. Mortgage Insurance

You won't need to worry about mortgage insurance if you’ve put 20 percent down on your home. If you’ve put down less, however, your lender will likely require you to have private mortgage insurance (PMI). The factors that influence the cost of PMI include, but are not limited to:

- Credit score

- Debt-to-income ratio

- The size of your loan

- Your down payment amount

Thankfully, unlike homeowner’s insurance and property taxes, you won’t have this expense forever. Once you've reached 20 percent equity in your home or an 80 percent loan-to-value (LTV) ratio on your mortgage, loan servicers terminate your PMI. With that in mind, consider making at least one extra mortgage payment a year to eliminate the added expense as soon as possible.

6. Property Taxes

Once you own a home, you’re responsible for property taxes. Taxing authorities calculate property taxes by assessing a property’s value and multiplying it by the “mill levy” or tax rate in a given area—effective property tax rates on a county basis range from 0.87% to 2.45%.

Pennsylvania’s average property tax rates are significantly higher than national averages. The state currently carries a 1.36% average effective property tax rate compared to the 0.99% national average. In Erie County, specifically, the tax rate is 1.94%. So, for example, if you own a $500,000 house, your annual property taxes will be around $9,700.

7. Utilities

There is a reason why the thermostat-protective dad has become a stereotype. Utility bills can add up fast, especially during the winter and summer. But heating and cooling expenses are only part of the equation. Utility bills include:

- Cable/Internet

- Electric

- Gas

- Phone

- Trash

- Water/Sewer

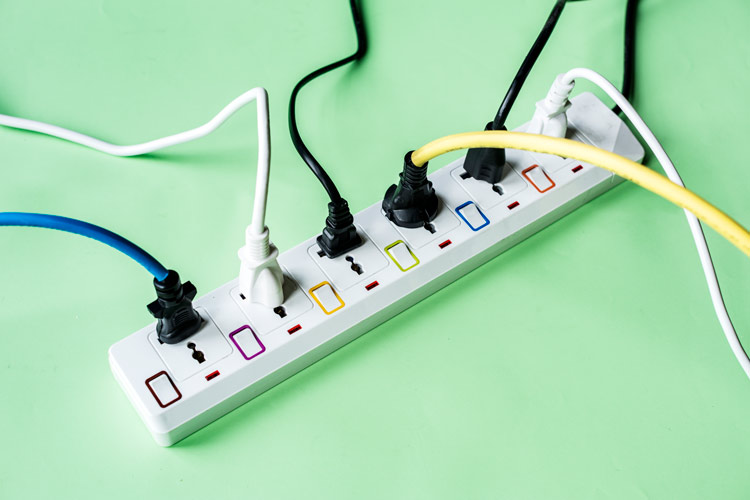

To save money on your utility bills, consider trying these six simple tips to be more energy efficient:

- Buy advanced power strips

- Use LEDs

- Invest in energy-efficient windows

- Patch up insulation

- Integrate Smart Home technology

- Fix any leaks

Find a Home that Fits Your Budget

Between property tax, insurance, maintenance, and everything else, we know a lot comes with owning a home. Keeping all these expenses in mind, Maleno helps aspiring home buyers find homes that align with their short and long-term budgets. And, despite the hidden costs of homeownership, buying a home is often one of the best investments you can make in your lifetime. Whether you’re interested in finding your starter home or discovering your forever home, reach out to Maleno today to get started.